Let’s face it—money is one of the most talked-about yet least-understood topics in our lives. Whether you’re dreaming of an early retirement, planning your next big vacation, or simply trying to make ends meet, the key to financial success lies in one simple yet powerful tool: budgeting.

- Why Budgeting Matters More Than Ever in 2025

- Debunking Common Budgeting Myths

- Step 1: Assess Your Financial Situation

- Step 2: Choose Your Budgeting Method

- Step 3: Tools to Automate Your Budget in 2025

- Step 4: Avoid These Budget-Killing Mistakes

- Step 5: Stick to Your Budget (Without Losing Your Mind)

- Conclusion: Your Blueprint for Financial Freedom

- FAQs: Answering Your Burning Questions

- Final Thoughts

But here’s the thing: budgeting isn’t just about cutting back on lattes (though we’ll talk about those too). It’s about taking control of your money so that you decide where it goes—not your impulses, not societal pressures, and certainly not unnecessary subscriptions lurking in the shadows of your bank statements.

In this ultimate guide, we’ll dive deep into why budgeting is your secret weapon for mastering finances in 2025—and how you can use it to create a life filled with freedom, security, and even a little fun along the way. From actionable tips to myth-busting truths, this article will equip you with everything you need to transform your financial future. So grab a cup of coffee (or tea if you’re cutting costs 😉), and let’s get started!

Why Budgeting Matters More Than Ever in 2025

The world is changing faster than ever before, and so are our financial landscapes. Rising living costs, unpredictable markets, and shifting career dynamics mean that having a solid grip on your finances has never been more critical. Here’s why budgeting should be at the top of your priority list:

1. Ditch the Paycheck-to-Paycheck Cycle

Living paycheck-to-paycheck doesn’t just leave you stressed—it leaves you vulnerable. Without a buffer, unexpected expenses like car repairs or medical bills can send you spiraling into debt. A budget gives every dollar a purpose, helping you break free from the cycle of living hand-to-mouth.

Pro Tip: Start by identifying non-essential spending. For example, swapping takeout meals for home-cooked dinners could save you hundreds each month.

2. Achieve Your Dreams Faster

Want to buy a house? Travel the world? Start a business? A budget helps you allocate resources toward these goals without guilt. By prioritizing what truly matters to you, you can turn dreams into reality—one paycheck at a time.

Real-Life Example: Sarah, a college student, saved $5,000 in just one year by sticking to a strict meal prep plan and cutting out impulse buys. She used that money to fund her dream internship abroad.

3. Sleep Better at Night

Did you know that nearly 80% of adults lose sleep over money worries? A budget replaces anxiety with clarity, giving you peace of mind knowing exactly where your money is going. And trust us—there’s nothing quite like the feeling of financial security.

Debunking Common Budgeting Myths

Before we dive deeper, let’s address some common misconceptions about budgeting. These myths often hold people back from taking the first step toward financial empowerment.

Myth #1: “Budgets Are Only for People Who Are Broke”

Truth: Even millionaires budget! Budgeting isn’t about restricting yourself—it’s about being intentional with your money. Whether you earn $30,000 or $300,000 per year, a budget ensures your hard-earned cash works as hard as you do.

Myth #2: “Budgeting Takes Too Much Time”

Truth: Thanks to modern technology, apps like Mint, YNAB (You Need a Budget), and PocketGuard automate up to 90% of the process. All you need is a few minutes a week to review your progress.

Myth #3: “I Don’t Make Enough Money to Budget”

Truth: If anything, having a limited income makes budgeting more important. When every dollar counts, knowing where it goes becomes essential for survival—and eventual prosperity.

Step 1: Assess Your Financial Situation

Before you can fix your finances, you need to know where you stand. This step might feel uncomfortable, but trust us—it’s worth it.

Calculate Your Income

List all sources of income, including:

- Paychecks

- Side hustles (freelancing, gig work, etc.)

- Passive income (rental properties, dividends, royalties)

For instance:

- Monthly paycheck: $3,500

- Freelance gigs: $500

- Total monthly income: $4,000

Track Every Penny

For 30 days, log every single expense. Use tools like:

- A notes app on your phone

- Apps like Mint or YNAB

- Good old-fashioned pen and paper

This exercise will help you spot “money leaks”—those sneaky expenses that add up over time.

Spotlight on Money Leaks:

- Daily coffee habit: $150/month

- Forgotten subscriptions: $12/month for an app you never use

- Impulse buys: Late-night Amazon sprees costing $50+ weekly

Step 2: Choose Your Budgeting Method

Not all budgets are created equal. Let’s explore three popular methods to find the one that suits your lifestyle best.

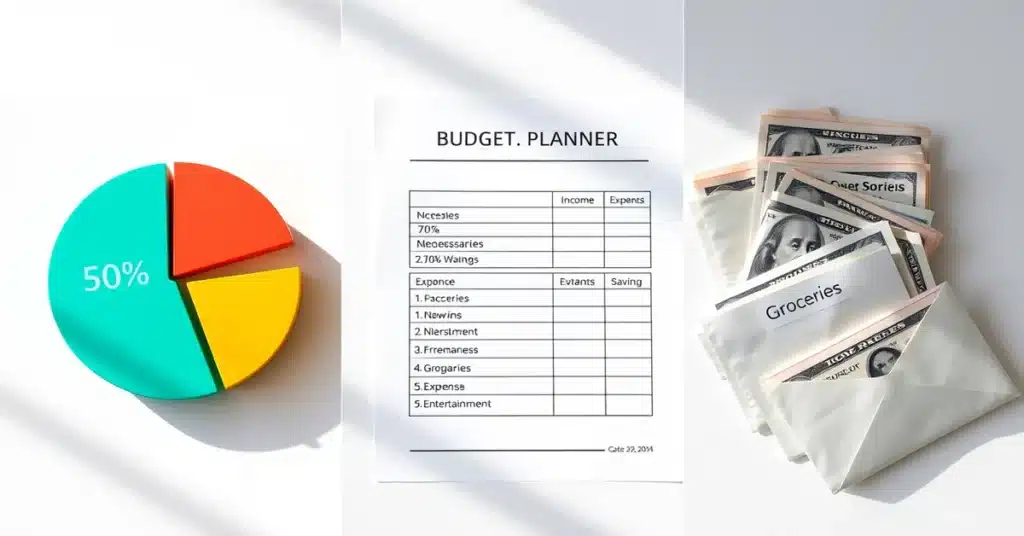

Option 1: The 50/30/20 Rule

Perfect for beginners who want structure without micromanaging.

- 50% Needs: Rent, utilities, groceries

- 30% Wants: Dining out, hobbies, entertainment

- 20% Savings/Debt: Emergency fund, retirement, loan repayments

Option 2: Zero-Based Budgeting

Ideal for detail-oriented individuals who crave total control.

- Assign every dollar a job. At the end of the month, your income minus expenses equals zero.

- Example: Earn $4,000? Allocate $2,000 to needs, $1,200 to wants, and $800 to savings/debt.

Option 3: Cash Envelope System

Old-school discipline for overspenders.

- Withdraw cash for categories like groceries and entertainment.

- Once the envelope is empty, stop spending.

Step 3: Tools to Automate Your Budget in 2025

Gone are the days of manual spreadsheets. Today’s tech-savvy tools make budgeting easier than ever.

Top Apps for 2025

- Mint: Free, auto-tracks spending, and sets goals.

- YNAB: Teaches proactive planning ($15/month).

- PocketGuard: Simplifies budgeting with a “what’s left to spend” feature.

Pro Tip: Sync apps to your bank account for real-time updates and set alerts for overspending.

Step 4: Avoid These Budget-Killing Mistakes

Even the best-laid plans can go awry if you fall into common traps. Here’s how to avoid them:

Mistake #1: Ignoring Small Purchases

Fix: Track everything—even snacks. That $3 latte adds up to $90/month.

Mistake #2: No Emergency Fund

Fix: Start with $500, then aim for 3–6 months’ worth of expenses.

Mistake #3: Overcomplicating Your Plan

Fix: Begin with three categories: Spend, Save, and Debt. Refine later.

Step 5: Stick to Your Budget (Without Losing Your Mind)

Sticking to a budget requires discipline—but also flexibility. Here’s how to stay on track:

Start Small

Save $20/week before aiming for $200.

Visualize Goals

Tape a picture of your dream vacation to your credit card.

Reward Wins

Saved $500? Treat yourself to a fancy coffee.

Adjust Often

Got a raise? Allocate 50% to savings, and 50% to fun.

Conclusion: Your Blueprint for Financial Freedom

Budgeting isn’t about perfection—it’s about progress. In 2025, take charge of your finances with a plan that adapts to your life. Remember:

- Track your spending (no excuses!).

- Choose a method that fits your vibe.

- Let apps handle the heavy lifting.

Ready to stop surviving and start thriving? Your future self will thank you.

FAQs: Answering Your Burning Questions

Q1: What if my income changes every month?

A: Base your budget on your lowest monthly income. Save extra during high-income months.

Q2: Can I budget if I’m drowning in debt?

A: Absolutely! Prioritize minimum payments, then attack high-interest debt first.

Q3: How do I handle surprise expenses?

A: Build a “Life Happens” fund ($50–$100/month).

Q4: I hate spreadsheets. Help!

A: Try Copilot—a voice-activated budget app. Just say, “Log $10 for coffee.”

Q5: How often should I tweak my budget?

A: Review it monthly. Life changes—your budget should too!

Final Thoughts

Budgeting is your ticket to financial freedom in 2025 and beyond. By implementing the strategies outlined above, you’ll gain control over your money, achieve your goals faster, and enjoy peace of mind. Start today—your wallet (and sanity) will thank you!