Investing in the stock market can feel overwhelming, especially if you’re just starting. But did you know that over 52% of Americans now own stocks? That’s right—investing isn’t just for Wall Street pros anymore! Whether you’re looking to build long-term wealth or simply want to dip your toes into the financial markets, this beginner’s guide has got you covered. In this article, I’ll walk you through everything you need to know about beginner stock market investing, from understanding the basics to picking your first stock. By the end, you’ll feel confident enough to take that first step toward financial freedom. Let’s dive in!

- What is Stock Market Investing? A Beginner-Friendly Overview

- Why Should Beginners Start Investing in the StockMarket?

- How to Get Started with Stock Market Investing in2025

- Key Concepts Every Beginner Investor Needs to Know

- Top Strategies for Beginner Stock Market Investors

- Tools and Resources to Help You Succeed in Stock Market Investing

- Common Mistakes to Avoid as a Beginner Investor

- Final Thoughts

- Conclusion:

- FAQs for “Beginner’s Guide to Stock Market Investing:How to Start Today”

What is Stock Market Investing? A Beginner-Friendly Overview

If you’ve ever wondered how people grow their wealth or heard terms like “stocks” and “shares,” you’re in the right place. Let’s break down stock market investing simply so you can feel confident about taking your first steps.

What is Stock Market Investing?

Stock market investing is simply buying small ownership stakes—called “stocks” or “shares”—in publicly traded companies. When you buy a stock, you own a tiny piece of that company. If the company does well and its value increases, so does the value of your shares. Think of it like planting a seed: you invest a little money today, nurture it with patience, and watch it grow into something much bigger. Over time, this process can help you build wealth.

How Does the Stock Market Work?

The stock market is like a giant marketplace where people buy, sell, and trade stocks. Companies list their shares on exchanges like the New York Stock Exchange (NYSE) or NASDAQ to raise money for growth. Investors then buy these shares through brokers or online platforms. Here’s how it works:

● Buying: You purchase shares at the current price, hoping their value will increase.

● Selling: If the stock’s price rises, you can sell your shares for a profit. For example, if you buy 10 shares at $50 each and the price rises to $70, you’ve made $200 (minus fees).

● Trading: Stocks are bought and sold daily, with prices fluctuating based on supply and demand, company performance, and economic factors.

Why Should You Invest in Stocks?

Investing in stocks offers several benefits:

● Wealth Growth: Historically, the stock market has returned 7-10% annually, outpacing savings accounts and bonds.

● Dividends: Some companies pay dividends, giving you passive income even if the stock price doesn’t rise.

● Ownership: You get a stake in successful companies and benefit from their growth.

● Liquidity: Stocks are easy to buy and sell, making them flexible for investors.

Common Misconceptions About the Stock Market

Let’s clear up some myths:

- “I need a lot of money.” Not true! Apps like Robinhood or Acorns let you start with as little as $5.

- “It’s gambling.” With research and strategy, investing is far from gambling.

- “I’ll lose everything.” Diversification reduces this risk by spreading investments across different stocks.

- “I need to time the market.” Timing the market is nearly impossible—focus on long-term growth instead.

A Quick History of the Stock Market

The stock market dates back to the 1600s when the Dutch East India Company issued the first shares. In the U.S., the NYSE began in 1792 under a buttonwood tree on Wall Street. Over centuries, events like the Great Depression and the 2008 financial crisis shaped its resilience. Today, online platforms have made investing more accessible than ever. By understanding the basics and avoiding common mistakes, you’re ready to take your first step toward becoming a confident investor.

Why Should Beginners Start Investing in the Stock

Market?

If you’ve ever wondered why everyone’s talking about investing, here’s the secret: the stock market is one of the best ways to grow your wealth over time. Let me break it down for you.

The Magic of Compound Interest

Compound interest is like a snowball rolling downhill—it grows bigger as it rolls. When you invest, your money earns returns, and those returns generate even more returns. For example, if you invest just $100 monthly at a 7% annual return, in 30 years, you’ll have over $100,000—even though you only contributed $36,000! The earlier you start, the more time your money has to multiply. That’s the power of long-term investing—it works hard for you while you sleep.

Stock Market Returns Beat Savings Accounts

Historically, the stock market has returned 7-10% annually on average. Sure, there are ups and downs, but staying invested pays off. For instance, someone who invested $10,000 in the S&P 500 in 2000 would have seen it grow to over $60,000 by 2023. Compare that to a savings account, where your money might barely keep up with inflation. Investing ensures your money grows faster than prices rise, preserving your purchasing power.

Real-Life Success Stories

Take Sarah, a teacher who started investing $200 monthly at age 25. By 50, she had over $300,000 thanks to consistent contributions and compound growth. Or John, who nervously bought his first stock but learned along the way and retired early. These stories prove anyone can succeed with patience and discipline.

Addressing Fears: You’ve Got This!

It’s normal to fear losing money, but diversification (spreading investments) reduces risk. Start small, focus on learning, and avoid panic-selling during downturns. Markets recover over time, and with discipline, you’ll thrive. So why wait? Your future self will thank you!

How to Get Started with Stock Market Investing in

2025

Step-by-Step Guide to Opening a Brokerage Account

Getting started is easier than ever. First, choose a reputable online broker like Robinhood, Fidelity, or TD Ameritrade. Visit their website or app, click “Sign Up,” and provide basic details like your name, address, and Social Security number. Verify your identity by uploading a photo ID, and you’re ready to fund your account. Most platforms guide you through the process step-by-step, making it beginner-friendly.

Compare Popular Online Brokers

Different brokers cater to different needs:

● Robinhood: Great for beginners with $0 commission trades but fewer research tools.

● Fidelity: Offers no-fee index funds, excellent educational resources, and strong customer support.

● TD Ameritrade: Perfect for those who want advanced trading tools and educational content.

Choose one that aligns with your goals and budget.

Set Clear Investment Goals

Are you investing for short-term goals (like a vacation) or long-term ones (like retirement)? Short-term investments should be safer, while long-term goals can take more risk for higher rewards. Setting goals keeps you focused and disciplined.

How Much Money Do You Need?

The best part? You don’t need thousands to start! Many brokers let you begin with as little as $5 or offer fractional shares, allowing you to buy part of an expensive stock like Amazon. Apps like Acorns or Stash make micro-investing easy.

Tips for Funding Your Account and Making Your First Trade

Fund your account via bank transfer or debit card, and start small. For your first trade, consider low-cost index funds or ETFs—they’re diversified and less risky. Research before buying, avoid emotional decisions, and remember: investing is a marathon, not a sprint! With these steps, you’re ready to grow your wealth in 2025.

Key Concepts Every Beginner Investor Needs to Know

Define Key Terms: Stocks, ETFs, Mutual Funds, Dividends, etc

● Stocks: A stock represents ownership in a company. When you buy a stock, you own a small piece of that business.

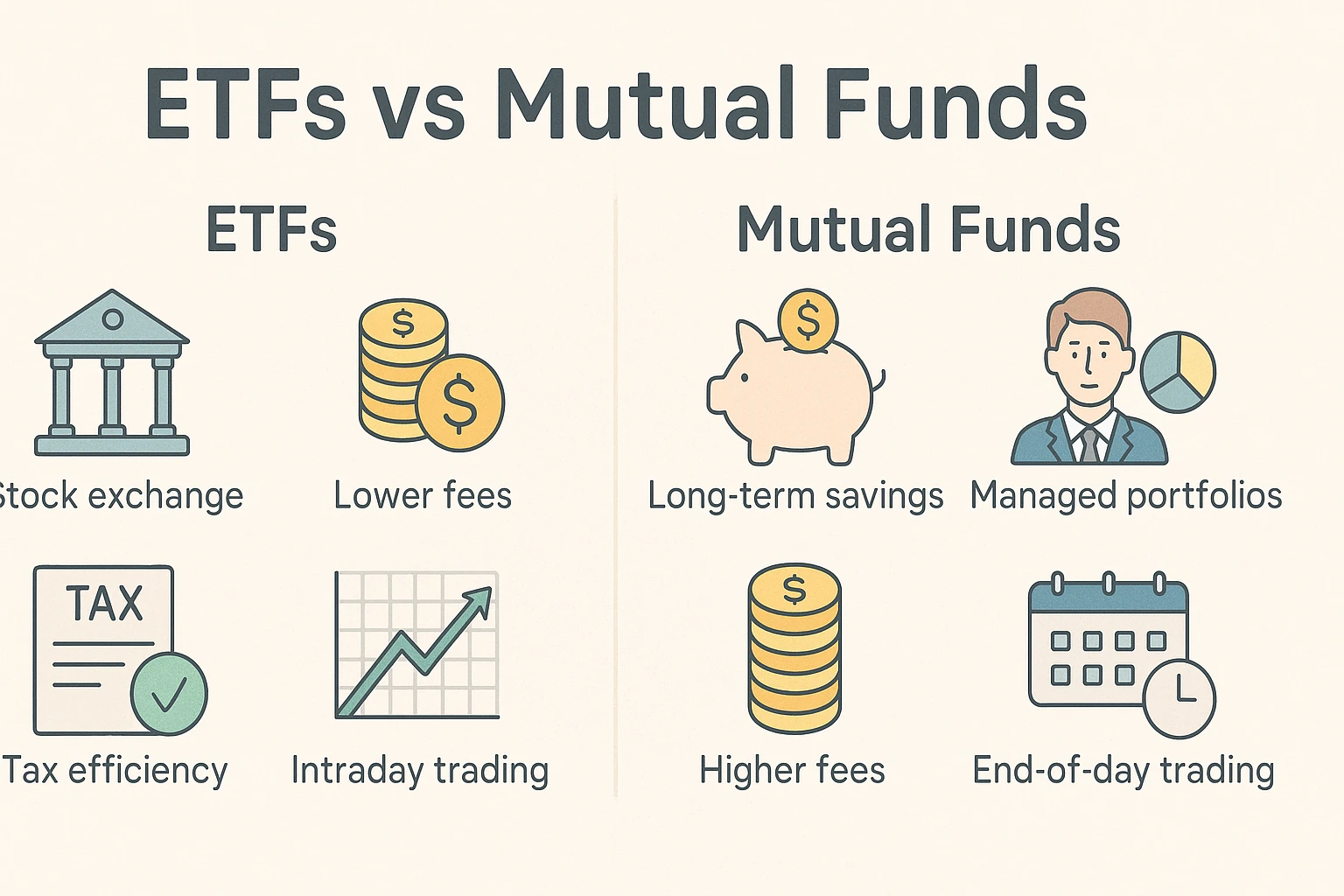

● ETFs (Exchange-Traded Funds): These are baskets of stocks or bonds traded on the stock market. They offer diversification and are often cheaper than buying individual stocks.

● Mutual Funds: Similar to ETFs, mutual funds pool money from many investors to buy a diversified portfolio of assets. However, they’re only traded at the end of the trading day.

● Dividends: Some companies pay dividends, which are portions of their profits distributed to shareholders. This provides passive income even if the stock price doesn’t rise.

Explain the Difference Between Growth Stocks and Value Stocks

Growth Stocks: These are shares of companies expected to grow faster than average, like tech startups. They rarely pay dividends but focus on reinvesting profits for expansion. Ideal for long-term investors seeking high returns.

● Value Stocks: These are undervalued companies trading below their true worth. Often found in stable industries, they may pay dividends and appeal to conservative investors looking for steady gains.

Discuss Market Indices (e.g., S&P 500, Dow Jones) and Their Significance

Market indices track the performance of a group of stocks. The S&P 500 includes 500 large U.S. companies and is a benchmark for the overall market. The Dow Jones tracks 30 major companies and reflects economic trends. These indices help investors gauge market health and compare their portfolio’s performance.

Teach Readers How to Read Stock Charts and Understand Price Movements

Stock charts show a stock’s price over time. Look for patterns like upward trends (bullish) or downward trends (bearish). Pay attention to volume—high trading activity can indicate strong investor interest. Learn basic indicators like moving averages to spot trends easily.

Highlight the Importance of Diversification and Risk Management

Diversification means spreading investments across different assets (stocks, ETFs, bonds) to reduce risk. If one investment performs poorly, others may balance it out. Always invest within your risk tolerance and avoid putting all your money into one stock or sector. This protects your portfolio from significant losses during market downturns.

Top Strategies for Beginner Stock Market Investors

If you’re new to investing, don’t worry—there are simple, proven strategies to help you build wealth without the stress. Let’s dive into some of the best approaches for beginners.

Dollar-Cost Averaging: Your Secret Weapon

Dollar-cost averaging (DCA) is perfect for beginners who feel overwhelmed by market swings. It’s simple: invest a fixed amount of money at regular intervals, like $100 every month, no matter what the market’s doing. This strategy smooths out volatility because you buy more shares when prices are low and fewer when prices are high. The best part? You don’t need to time the market—a consistent approach keeps you disciplined and focused on long-term growth.

Index Fund Investing: Low-Risk, High-Reward

Index funds are a beginner’s best friend. These funds track a market index like the S&P 500, giving you instant diversification across hundreds of stocks. Since they’re passively managed, they come with lower fees than actively managed funds. Plus, history shows that markets tend to grow over time, so investing in an index fund is a low-risk way to ride the wave of long-term gains.

Dividend Investing: Earn While You Sleep

Want passive income? Dividend stocks pay you portions of a company’s profits, even if the stock price doesn’t budge. For example, owning 100 shares of a company paying $1 per share annually nets you $100 effortlessly. These stocks often come from stable companies, making them less volatile than growth stocks—a great option for steady returns.

Growth vs. Value Investing: Pick Your Path

● Growth Stocks: Think tech startups or companies expanding rapidly. They rarely pay dividends but offer high returns over time. Best for risk-tolerant investors.

● Value Stocks: These are undervalued gems trading below their true worth. Often safer and dividend-paying, they appeal to conservative investors seeking stability.

Avoid Beginner Mistakes: Stay Smart

Don’t let emotions rule your decisions—avoid panic-selling during dips or chasing “hot tips.” Diversify your portfolio, stick to your plan, and only invest money you won’t need soon. Tools like stop-loss orders can protect against big losses. Remember, patience and consistency are your keys to success. With these strategies, you’re ready to crush your investing goals!

Tools and Resources to Help You Succeed in Stock Market Investing

List of Free Stock Screeners and Research Tools (e.g., Yahoo Finance, Morningstar)

Free tools are a great way to start your investing journey. Yahoo Finance offers real-time stock quotes, news, and basic charting tools. Morningstar provides in-depth analysis, ratings, and insights into stocks, mutual funds, and ETFs. Other useful screeners include Finviz, which helps filter stocks by criteria like price, sector, and performance, and TradingView, known for its advanced charting features. These tools help you research companies, track market trends, and make informed decisions without spending a dime.

Best Apps for Tracking Your Portfolio and Monitoring Performance

Apps like Robinhood, Webull, and Acorns let you invest and monitor your portfolio on the go. For more advanced tracking, Personal Capital offers portfolio management tools and retirement planning features. M1 Finance combines investing and budgeting, allowing you to automate your investments while tracking performance. These apps provide real-time updates, making it easy to stay on top of your investments.

Recommended Books, Podcasts, and YouTube Channels for Beginners

Books like The Intelligent Investor by Benjamin Graham and A Random Walk Down Wall Street by Burton Malkiel are must-read. For podcasts, check out The Motley Fool or We Study Billionaires, which break down complex topics into digestible insights. On YouTube, channels like Graham Stephan and Meet Kevin offer beginner-friendly advice on investing and personal finance.

Online Communities and Forums for Learning and Networking

Join communities like Reddit’s r/investing or Bogleheads, where investors share tips and discuss strategies. Platforms like StockTwits allow you to follow trending stocks and connect with other traders. These forums are great for asking questions, learning from others, and staying updated on market trends.

Paid Resources Worth Considering (e.g., Courses, Newsletters)

Consider paid resources like Investopedia Academy for structured courses or newsletters like Morning Brew and The Motley Fool Stock Advisor for expert recommendations. While free tools are helpful, paid resources often provide deeper insights and personalized guidance to accelerate your learning

Common Mistakes to Avoid as a Beginner Investor

Investing in the stock market can be an exciting journey, but it’s easy to make mistakes when you’re just starting. These errors can cost you money, time, and peace of mind. To help you stay on the right path, here are five common mistakes every beginner investor should avoid —and how to steer clear of them.

- Chasing “Hot Tips” and Speculative Stocks

It’s tempting to jump on the latest stock tip you hear from a friend, social media influencer, or financial news outlet. After all, who doesn’t want to get rich quickly? However, these speculative stocks often lack long-term value and are driven by hype rather than solid fundamentals. For example, buying into a trending stock without doing your research can lead to significant losses if the hype fades or the company fails to deliver results. Instead of chasing quick wins, focus on companies with strong track records, clear business

models, and long-term growth potential. Always do your research before investing—your future self will thank you! - Overtrading and Racking Up Fees

Many beginners fall into the trap of overtrading—buying and selling stocks too frequently in an attempt to “time the market.” While this might sound like a smart strategy, it’s nearly impossible to predict short-term market movements consistently. Overtrading not only increases transaction fees but also triggers taxes on capital gains, eating into your returns. Instead, adopt a buy-and-hold strategy. Focus on long-term growth rather than short-term gains. This approach minimizes costs and allows your investments to benefit from the power of compounding over time. - Letting Emotions Dictate Your Investment Decisions

The stock market can be a rollercoaster, and emotions like fear and greed often take the wheel during volatile times. Panic-selling during a market dip or getting overly excited during a rally can derail your investment strategy. Remember, markets tend to recover over time, and emotional decisions rarely lead to good outcomes. Stick to your plan, avoid impulsive actions, and trust the process. A disciplined, rational approach will serve you far better in the long run than knee-jerk reactions to market swings. - Failing to Diversify Your Portfolio

Putting all your eggs in one basket is a recipe for disaster in the investing world. If you invest all your money in a single stock or sector and it performs poorly, your entire portfolio could suffer. Diversification is key to managing risk. By spreading your investments across different assets—like stocks, ETFs, bonds, or even real estate—you reduce the impact of any one investment’s failure. For instance, owning an S&P 500 index fund gives you exposure to 500 companies across various industries, providing built-in diversification and stability. - Not Having a Clear Investment Plan or Goal

Without a clear goal, it’s easy to lose focus and make poor decisions. Are you investing for retirement, a down payment on a house, or passive income? Defining your objectives helps you create a roadmap for success. For example, set a monthly contribution goal and choose investments that align with your timeline. A well-thought-out plan keeps you disciplined and reduces the temptation to stray from your strategy. Whether you’re aiming for short-term gains or long-term wealth building, having a plan ensures you stay on track.

Final Thoughts

Avoiding these common mistakes can save you from unnecessary stress and financial setbacks as you begin your investing journey. By focusing on research, discipline, diversification, and clear goals, you’ll set yourself up for long-term success. Remember, investing is a marathon, not a sprint—stay patient, stay informed, and watch your wealth grow over time

Conclusion:

Investing in the stock market might seem intimidating at first, but with the right knowledge and tools, anyone can get started—even beginners! Remember, the key to success lies in education, patience, and consistency. Start small, stay disciplined, and focus on long-term growth rather than short-term gains. Ready to take the plunge? Open a brokerage account today and make your first investment. Trust me, your future self will thank you! If you found this guide helpful, share it with a friend who’s also interested in beginner stock market investing.

Happy investing!

FAQs for “Beginner’s Guide to Stock Market Investing:

How to Start Today”

1. What is stock market investing, and how does it work?

Stock market investing involves buying publicly traded company shares to grow

your wealth over time. When you purchase a stock, you own a small piece of that

company. If the company performs well, the value of your shares may increase,

allowing you to sell them for a profit. The stock market acts as a marketplace where

investors buy, sell, and trade these shares through exchanges like the NYSE or

NASDAQ.

2. Do I need a lot of money to start investing in the stock market?

No, you don’t need a lot of money to start! Many online brokers allow you to begin

with as little as $5 or even offer fractional shares, which let you buy a portion of an

expensive stock. Apps like Robinhood, Acorns, and Stash make it easy for beginners

to invest small amounts regularly.

3. What are the benefits of investing in the stock market?

Investing in the stock market offers several advantages:

● Wealth Growth: Historically, stocks have returned 7-10% annually on average, outpacing savings accounts and inflation.

● Dividends: Some companies pay dividends, providing passive income.

● Ownership: You gain a stake in successful companies and benefit from their growth.

● Liquidity: Stocks can be easily bought and sold, offering flexibility.

4. Is investing in the stock market risky?

Yes, investing always carries some risk, as stock prices can fluctuate due to market

conditions, company performance, and economic factors. However, risks can be

minimized by diversifying your portfolio, investing for the long term, and avoiding

emotional decisions. Remember, higher risks often come with higher potential

rewards.

5. What’s the difference between growth stocks and value stocks?

● Growth Stocks: These are shares of companies expected to grow faster than

average, such as tech startups. They rarely pay dividends but focus on

reinvesting profits for expansion.

● Value Stocks: These are undervalued companies trading below their true

worth. Often found in stable industries, they may pay dividends and appeal to

conservative investors seeking steady gains.

6. What tools can help me research and track my investments?

There are many free and paid tools available:

● Free Tools: Yahoo Finance, Morningstar, Finviz, and TradingView for stock

screeners and research.

● Portfolio Trackers: Apps like Robinhood, Webull, and Personal Capital help

monitor your investments.

● Learning Resources: Books like The Intelligent Investor , podcasts like The

Motley Fool and YouTube channels like Graham Stephan are great for

beginners.

7. What is dollar-cost averaging, and why is it good for beginners?

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed

amount of money at regular intervals, regardless of stock prices. For example, you

might invest $100 monthly into an index fund. This approach reduces the impact of

market volatility and eliminates the stress of timing the market, making it ideal for

beginners.

8. Should I invest in individual stocks or index funds?

Both options have pros and cons:

● Individual Stocks: Offer higher potential returns but come with more risk. They

require research and monitoring.

● Index Funds: Provide instant diversification by tracking a market index like the

S&P 500. They’re low-cost, low-risk, and beginner-friendly.

For most beginners, starting with index funds is a safer and simpler choice.

9. How do I avoid common mistakes as a beginner investor?

To avoid pitfalls:

● Don’t chase “hot tips” or speculative stocks—always do your research.

● Avoid overtrading, as fees and taxes can eat into your returns.

● Keep emotions in check and stick to your long-term plan.

● Diversify your portfolio to reduce risk.

● Set clear investment goals to stay focused.

10. Can I lose all my money in the stock market?

While it’s possible to lose money, especially if you invest in risky assets or fail to

diversify, you’re unlikely to lose everything if you follow sound practices. Diversifying

your investments, avoiding speculative stocks, and staying invested for the long term

can significantly reduce the chances of major losses.

11. What should I do if the market crashes?

Market downturns are normal and often temporary. Instead of panic-selling, stay

calm and remember that markets tend to recover over time. Use a downturn as an

opportunity to buy quality stocks at lower prices if you have a long-term perspective.

Stick to your plan and avoid making impulsive decisions based on short-term

fluctuations.

12. How do dividends work, and should I invest in dividend-paying stocks?

Dividends are portions of a company’s profits distributed to shareholders, usually

quarterly. They provide passive income and are often paid by stable, established

companies. Dividend investing is a great option if you’re looking for steady cash flow,

but it’s important to also consider the company’s overall health and growth potential

before investing.

13. How much time does investing take?

The time commitment depends on your strategy:

● Passive Investing: Index funds and ETFs require minimal effort once set up,

making them ideal for busy beginners.

● Active Investing: Picking individual stocks requires more research, monitoring,

and decision-making.

Regardless of your approach, consistency and discipline are key to success.