Hey, ever wonder how to track your expenses like a pro using free tools? One minute you’ve got some bucks—maybe from Allowance Day, a birthday card, or that weekend gig—and the next, poof! It’s vanished, and you’re like, “Did I really spend it all?” Don’t sweat it—you’re not alone! Over 60% of Americans live paycheck to paycheck, burning through every dollar before the next one lands. Why? They’re not keeping an eye on their spending. But here’s the exciting twist—you don’t need a money guru or fancy apps to take the wheel. With free tools, you can turn into a money-tracking champ and start building a future where you call the shots!

In this Blog, I’m spilling the beans on how to use free tools to watch your cash like a pro. I’ll hook you up with the coolest options, sprinkle in some fun tips to nail it, and show you why tracking your money is a total game-changer. Want to stack cash for a new phone, a wild trip, or just stop tossing it on random stuff? These tools will keep you sorted and ready to crush it. Let’s dive in and make your wallet do a happy dance!

Why Tracking Your Expenses Is a Big Deal

Picture this: You’ve got $50 on Monday, but by Friday, you’re flat broke—and you’re clueless about where it went! Sound like you? That’s where tracking swoops in like a hero. Famous thinker Benjamin Franklin once said,

Beware of little expenses; a small leak will sink a great ship.

He’s right—tracking is like plugging those leaks so your money stays safe!

Why Should You Care?

Tracking isn’t just numbers—it’s your ticket to rocking your money game. Here’s what it does:

- Stacks Up Your Savings: Keep more cash instead of letting it slip away.

- Kicks Waste to the Curb: Spot sneaky spend—like too many sodas—and ditch ‘em!

- Speeds Up Your Dreams: Eyeing a new game or a trip? Tracking gets you there quickly.

What’s in It for You?

Here’s the loot you scored:

- Crack the Spending Code: See if snacks or games are eating your cash.

- Stop the Money Leak: Catch yourself before you blow it all.

- Nail Your Goals: Bike, concert ticket, whatever—you’ll snag it faster.

Cool Stat Alert!

People who track their expenses save 20% more than those who don’t. That’s like pocketing an extra $20 for every $100 you grab—sweet, right?

Let’s Make It Real

Check these out:

- Saving for the Big Stuff: Want a $500 phone? Tracking might show you’re dropping $50 a month on junk—like extra candy. Cut it, and bam—phone in 10 months!

- Ditching the Waste: Grabbing a $3 coffee daily? That’s $90 a month! Track it, brew at home, and save over $1,000 a year. Coffee king Dave Ramsey would approve—he says,

You must gain control over your money or the lack of it will forever control you.

Coffee king Dave Ramsey

The Coolest Free Tools to Track Your Expenses

Ready to roll? Some wicked free tools make tracking your money a blast. I’ve rounded up five champs—let’s see what they bring, what’s awesome, and any tiny catches so you can pick your MVP.

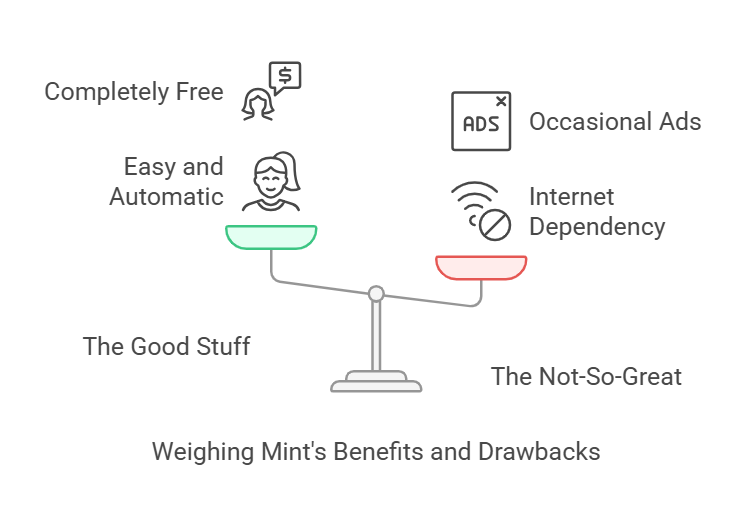

1. Mint: Your Money’s New Best Friend

What’s the Deal?

Mint’s like a genius buddy who’s got your back. It links to your bank, tracks every dime, builds budgets, and tosses in saving tips—all free! Learn more about Mint at Mint.com.

The Good Stuff:

- Crazy easy—just kick back and watch it work!

- Updates every time you spend a penny.

- Costs zilch—100% free!

- Budgets for snacks, movies, you name it.

The Not-So-Great:

- Needs internet to stay fresh.

- Ads pop up sometimes—like credit card pitches.

Perfect For: Anyone who wants a chill tool that runs the show.

2. YNAB (Free Trial): Boss Every Dollar

What’s the Deal?

YNAB (You Need A Budget) puts you in charge. You tell every dollar where to go before spending—total power move! Check it out at YNAB.com.

The Good Stuff:

- Turns you into a money pro.

- Sets you up for goals—like a new board.

- Free trial for 34 days—score!

The Not-So-Great:

- Costs after the trial ends (ugh).

- You’ve got to type your spending.

Perfect For: Control freaks who love planning.

3. Google Sheets: Your Money Playground

What’s the Deal?

Google Sheets is your blank slate—write down earnings and spends, and jazz it up your way! Get started with templates at Google.com/sheets.

The Good Stuff:

- Free as can be—zero bucks!

- Customize it—colors, charts, go wild.

- Works offline after setup.

The Not-So-Great:

- You type it all—no shortcuts.

- No bank auto-link.

Perfect For: Creative souls who dig DIY.

4. PocketGuard: Your Spending Sidekick

What’s the Deal?

PocketGuard checks your income, bills, and goals, then says, “Yo, you’ve got $50 to play with!” It’s your wingman. Explore it at PocketGuard.com.

The Good Stuff:

- Super simple—one number to track.

- Syncs with your bank—boom, updated!

- The free version is a solid deal.

The Not-So-Great:

- Fancy extras cost cash.

- Might feel weird if you’re a newbie.

Perfect For: Folks who want stress-free spending limits.

5. Wally: Your Daily Money Diary

What’s the Deal?

Wally’s a laid-back app for logging daily spending and earnings—like a pocket journal! Peek at it on Wally.me.

The Good Stuff:

- So easy—a kid could rock it!

- Tracks spending AND what you make.

- Free—no hidden catches.

The Not-So-Great:

- All manual—no auto-help.

- No big extras like budgets.

Perfect For: Chill trackers who keep it simple.

How to Pick Your Winner

Lost on which to grab? Here’s the vibe:

- Love auto-magic? Snag Mint or PocketGuard.

- Want to rule? Hit Google Sheets or YNAB.

- Keep it easy? Roll with Wally.

Savings High-Five!

Using Mint, you spot $50 monthly on snacks. Drop it to $20—$360 saved in a year! Add PocketGuard’s safe-spend trick, and you’re swimming in cash. Warren Buffett says, “Do not save what is left after spending, but spend what is left after saving.” Smart, huh?

How to Rock These Tools Like a Champ

Tool picked? Sweet! Let’s set it up and crush it with these steps—soon you’ll be a money master.

Step 1: Get Your Spending in the Game

Feed your tool the goods:

- Auto Mode: Mint or PocketGuard? Link your bank (totally safe!). It grabs spends—like $5 on chips.

- DIY Mode: Google Sheets or Wally? You write it—$3 soda? Log in!

Step 2: Sort It Into Fun Boxes

Make it pop with groups:

- Cool Boxes: Try these:

- Food (groceries, takeout)

- Fun (games, movies)

- Bills (phone, Wi-Fi)

- Travel (bus, bike)

- Treats (soda, candy)

- How to Sort: Apps tag it; Sheets need columns—fill ‘em up!

- Why It’s a Win: See if treats are stealing your cash.

Step 3: Set Limits and Get Alerts

Keep it tight:

- Make Limits: Set caps—like $50 food, $20 treats.

- Turn On Buzzers: Mint pings you—“Hey, $18 on treats—chill!”

Stay in the Groove

- Peek Weekly: Check Sundays—stay sharp!

- Log Quick: DIY tools? Write fast—no memory fails.

- Monthly Victory Lap: Review, cheer, tweak!

- Party for Wins: Saved $10? Dance it out!

Mint Setup in Action

Mint rocks like this:

- Grab it from the app store— bam!

- Link your bank—easy peasy.

- Fix any weird tags (snacks aren’t “bills”!).

- Set limits—$20 treats, go!

- Watch for “slow down!” buzzes.

Cash Bonus!

Cut $10 weekly on treats? $520 yearly! Trim $15 monthly fun? $180 more! You’re a savings ninja!

Oopsies to Dodge

Tracking’s a blast, but watch these slip-ups—they’ll trip you up if you’re not careful!

1. Mixing Up Boxes

Oops: Everything’s “random”—no clue what’s what. Fix: Tag it right—$5 “treats,” not “whatever.”

2. Ignoring Tiny Spends

Oops: Skipping $2 chips? They pile up! Fix: Track every cent—$3 drinks daily? $90 monthly!

3. Forgetting to Check

Oops: Setup and ghost it—missed wins! Fix: Peek weekly—stay ahead.

4. Blindly Trusting Auto

Oops: Apps goof—like food as “fun.” Fix: Check and tweak—keep it real.

5. Overdoing It

Oops: Too many boxes—it’s chaos! Fix: Keep it chill—food, fun, bills.

Why It’s Worth It

Dodge these, and you’re golden—more cash, less mess, total boss vibes!

Next-Level Money Moves

Ready to shine? These pro tricks make you a tracking legend:

- Team Up Tools: Mint’s auto + Google Sheets’ charts = unstoppable!

- Draw Cool Pics: Charts show treat overload—fun and smart!

- Set Epic Goals: $500 in 3 months? Track it!

- Auto Bills: Bills pay themselves—more chill time!

Cash Jackpot

Auto bills ($120/year), less treats ($240/year), $500 goal—over $850 saved! Oprah says, “You get in life what you have the courage to ask for.” Ask your money to stick around!

Real Kids, Real Wins

Emma’s $300 Comeback

Emma, a teacher, rocked Mint, cut $300 monthly on coffee and shopping—now she’s partying with pals!

John’s $5,000 Slam Dunk

John, a student, used Google Sheets, slashed dining out, and crushed $5,000 in debt in a year!

Ava’s $1,200 Dream

Ava, a teen barista, who owned PocketGuard, saved $1,200 in 6 months—laptop time! Your Turn?

Small moves + tracking = epic wins!

Let’s Wrap This Party Up

Tracking your cash is a blast with free tools! Pick one, stick it out, and watch your stash grow. Start now—your money’s ready to shine! As Albert Einstein said, “Compound interest is the eighth wonder of the world. He who understands it earns it.” Swap interest for tracking, and you’re golden!